does draftkings send tax forms

For Oregon activity please contact the DraftKings Customer Support team as the information in this article may not apply to you. Ohit sounds confusing as they send you to a link called taxform.

Draftkings And Golden Nugget Merger Imminent Online Casino Plans

FanDuel sent me a tax form just the other day dont use draftkings so Im not sure how they go about it.

. If you strike lucky and you take home a net profit of 600 or more for the year playing in sportsbooks such as DraftKings the operators have a legal duty to send both yourself and the IRS a Form 1099 -MISC. Does DraftKings issue tax documents. Fan Duel sent me mine via e-mail about a week ago.

If it turns out to be your lucky day and you take home a net profit of 600 or more for the year playing on websites such as DraftKings and FanDuel the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC. Daily Fantasy Tax Reporting. Please advise as to where I input this other income that is not considered gambling however it was gambling winnings.

The IRS limits your net loss to 3000. If you receive your winnings through PayPal the reporting form may be. Players on online forums have showed concern about DraftKings W9 requests during withdrawals and through email.

Chances are if you havent. You can expect to receive your tax forms no later than February 28. Can I offset these fantasy sports sites.

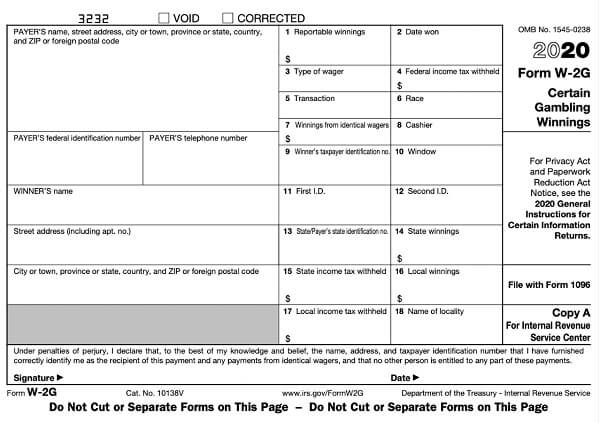

If it turns out to be your lucky day and you take home a net profit of 600 or more for the year playing on websites such as DraftKings and FanDuel the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC. Form W-2G from DraftKings just sharing We will issue a W-2G form each time a player has a payout of 600 or more no reduction for the wagered amount and a return that is 300X the amount wagered. If you qualify to receive tax forms from DraftKings IRS Forms 1099W-2G you can access the information directly from the Document Center.

Does draftkings send tax forms. We will withhold federal income tax from the winnings if the winnings minus the wager exceed 5000 and the winnings are at least 300 times the wager. Here are two of the basic irs forms used to report winnings from gambling including the standard personal income tax form.

If you select to receive your winnings via e-wallets such as PayPal the reporting form may be a 1099 -K. How much loss can you write off. If it turns out to be your lucky day and you take home a net profit of 600 or more for the year playing on websites such as DraftKings and FanDuel the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC.

This is standard operating procedure for daily and traditional sports betting sites and is one of the requirements for DraftKings and sites like it to stay in business. If you receive your winnings through PayPal the reporting form may be a 1099-K. Ive never needed one from Draft Kings so not sure on that front.

First of all you may not have hit the 600 threshold in profits last year to require a 1099 form to be sent to you. I received a 1099-Misc of 5661 from FanDuel and have filed that on my tax return. If you have winnings of over 600 from any Daily Fantasy Sports site such as FanDuel or DraftKings you will likely receive a Form 1099- MISC with the amount shown on Box 3.

Your maximum net capital loss in any tax year is 3000. You can expect to receive your tax forms no later than February 28. Fantasy sports winnings of at least 600 are reported to the IRS.

I will advise you to report net earnings of 1 but anything over 600 is what will be reported to the IRS. If it turns out to be your lucky day and you take home a net profit of 600 or more for the year playing on websites such as DraftKings and FanDuel the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC. If you receive your winnings through PayPal the reporting form may be a 1099-K.

If it turns out to be your lucky day and you take home a net profit of 600 or more for the year playing on websites such as DraftKings and FanDuel the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC. The first thing to realize is that any winnings are taxable and bettors should include it on a tax return. Does a W9 Form Mean You Owe Taxes.

6 rows Key tax dates for DraftKings - 2021. Dont panic DraftKings or any other daily fantasy site for that matter simply requests this information from all players so it is on file if they need to issue you a 1099 form. Forms 1099-MISC and Forms W-2G will become available.

The answer is yes your cumulative net profit is taxed and DraftKings is contractually required to send a 1099 tax form to any player that nets of 600 in profit in a calendar year. The only place I see where a 1099-MISC is applicable is Small Business Self employed which is not what my DRAFTKINGS form is from. If you qualify to receive tax forms from DraftKings IRS Forms 1099W-2G you can access the information directly from the Document Center.

Does DraftKings send you a tax form. On Draftkings I had a yearly loss of 1300.

Draftkings Sportsbook App 1 000 Bonus Mobile Android Ios

Draftkings Pennsylvania Sportsbook 1 Mobile Pa App 1 050 In Bonuses

Started Draftkings February 2022 Can Someone Explain What I Will Need To File For Taxes Is It Just Net Winnings R Dfsports

Draftkings Sportsbook Ohio The Best Sports Betting App Coming Soon

Draftkings Sportsbook Review 20 Up To 1000 Deposit Bonus

Draftkings Begins New Era With Official Launch Of Sportsbook In New Jersey Business Wire

Draftkings Tax Form 1099 Where To Find It How To Fill

Draftkings Ny Mobile Sportsbook App Promo Review Launch Details

Draftkings Tax Form 1099 Where To Find It How To Fill

Draftkings Promo Code 1 050 Sportsbook Bonus April 2022 Verified

Draftkings Sportsbook Indiana App User Guide Promo Code

Play Draftkings Or Fanduel The Irs Wants To Know About Your Winnings Nasdaq

How To Make A Draftkings Deposit Guide Banking Options

Draftkings Colorado Promo Code 1 050 Sportsbook Bonus

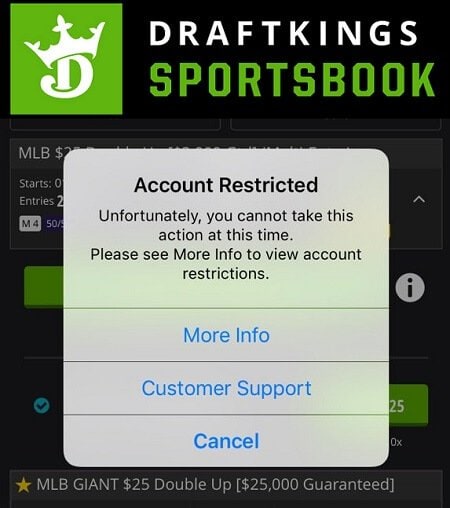

Restore Restricted Or Locked Draftkings Sportsbook Account

Draftkings Raises A Stink About Massachusetts Online Gaming Proposal Boston Business Journal

Draftkings To Pay 325k In Class Action Settlement Top Class Actions